Investing in a better future

AiiM Partners invests in technology companies in the four key sectors responsible for 84% of the global emissions. We are targeting the untapped potential of the $17 trillion industries addressing climate change and ocean health.

Investment focus

Companies with differentiated technologies, gaining market traction faster than their peers

We invest at the intersection of four key areas including energy transition, alternative materials, agriculture & food systems, and data & digitization.

How we're different

Invest where there is a market need

Leverage deep bench of experts

Target quantifiable outcomes

Select Investments

Energy Transition

Tackling the demand for hard-to-decarbonize materials like ammonia and fuels

Carbon sequestration providing a low-cost, scalable, energy efficient and verifiable solution

Low cost, energy efficient wastewater treatment and recovery

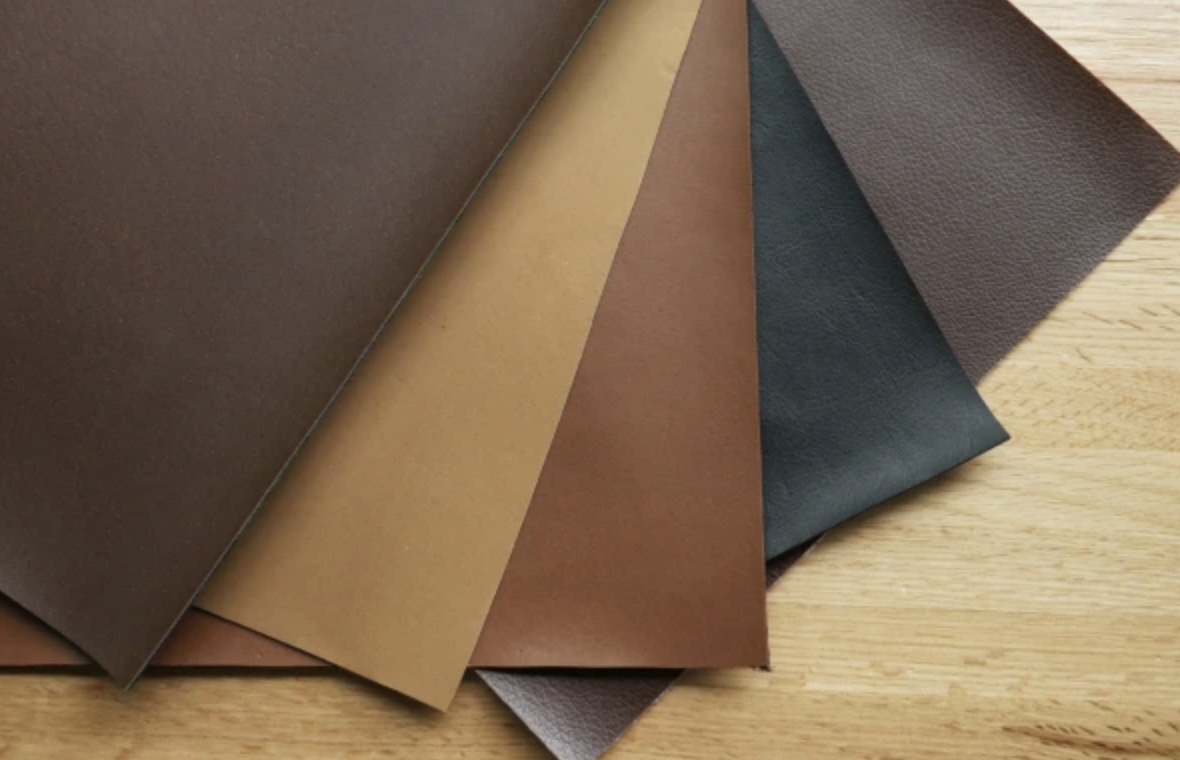

Alternative Materials

.png?width=162&height=57&name=nfw_logo_pri_b%20(1).png)

Alternative textile with high performance properties, lower emission and is plastic free

Replacing plastic in packaging

High value materials for batteries without supply constrained minerals

High value materials for batteries without supply constrained minerals

Ag & Food Systems

![]()

Meeting rising protein demand with lower carbon alternatives

![]()

Create the cleanest, most sustainable seafood on the planet

Using data to accelerate alternative protein ingredient discovery

Data & Digitization

Cost effective, secure data collection and computation that is less energy intensive

![]()

Supply chain transparency to mitigate climate risk, improve performance

Digital solution to reduce shipping fuel and emissions

AiiM companies in the news

Team

Shally Shanker, CFA

Founder and managing partner

Shally launched AiiM Partners after building a successful track record of demonstrating both returns and impact. She has over 22 years of investment management experience structuring and stewarding global portfolios totaling $19Bn. She has been involved with the boards of 20 private companies and has been an early investor in high-growth sectors such as applied AI, autonomous data collection and alternative protein.

James Dancer

OPERATING partner

James provides hands-on strategic, operational and technical expertise to AiiM portfolio companies and supports AiiM’s due diligence efforts in the data & digitization sector. He is a former diplomat, strategy consultant and corporate financier with over 25 years advising and building some of the largest and transformational deep tech industries globally (AI, energy, advanced materials, aerospace) and has worked at McKinsey & Co, UBS, Warburg, and Helsing.

Justin Manley

Technology ventUre partner

Justin has deep technical and sector expertise in ocean robotics, shipping, and marine technology and in his role provides sourcing and technical due diligence support in these areas. Justin has been working with marine technology and robotics since 1990 and is a recognized leader in unmanned systems development and operations. He is also currently a Senior Advisor at Oceankind.

Luke Halsey

partner

Luke leads development of key investment risk metrics covering financial, technology, and climate modeling for companies, oversees original research development on future investment areas, and provides portfolio company support. Luke brings over a decade of impact investing and innovation experience from institutions such as The Schmidt Family Foundation, Royal Agricultural University, and Social Finance.

Hailey Hu

Investment Director

Hailey joined AiiM Partners in 2020 and drives sourcing, due diligence and investment execution efforts with a particular focus on operational, financial and returns analysis, and also provides board support. She has over a decade of combined experience across investing (B Capital Group), consulting (Accenture), and impact (Grameen Foundation), and has lived and worked in the US, Europe, Africa, and Asia.

Dr. Preetish Ramasawmy

Sr. associate

Preetish joined AiiM Partners in 2021 and is focused on original technical research, developing technology roadmaps and pipeline management. He holds a PhD in Material Science and an MBA from University of Oxford. Preetish has a decade of deep technology expertise having played management and engineering roles at Airbus, BAE Systems and most recently as the lead engineer at JLR.

Ryan Penney

Research analyst

Ryan joined AiiM in 2022 and assists the team with modeling and sector deep dives across the portfolio. He holds degrees in oceanography and economics (Plymouth University, London School of Economics) and is finishing his PhD (Stanford University) conducting a novel analysis of trends in ocean innovation. Prior to AiiM, he worked as a marine policy consultant in Beijing.

Sameer Halai

Entreprenuer in residence

Sameer supports AiiM portfolio companies with product strategy & operations. He has co-founded several startups including Wehealth, Jirav, SunFunder with $200M+ raised in debt & equity and an exit. He has worked with the team for seven years and his experience spans early stage startups, R&D at Microsoft Research as well as global scale consumer products. He has degrees in computer engineering (University of Mumbai) and social computing (University of Michigan.)

Taylor Hoing

CFO

As the CFO, Taylor supports all of AiiM’s reporting, fund administration, legal, tax, audit and compliance functions. He has over twelve years of accounting and operating experience in the alternative investment industry, primarily focused on financial reporting, tax compliance, and administration of private equity and venture capital funds (Standish Management, Rothstein Kass, Andersen Tax).

Ben Tarbell

Venture Partner

Ben supports AiiM portfolio companies with product strategy and execution and helps develop the investment pipeline related to energy technology. He has over two decades of leadership experience across product, operations, and business development roles in the renewable energy, storage, and cleantech space (Google X, SolarCity, Mosaic, IDEO).

Mary Lou Song

OperatiONS

Mary Lou provides hands-on support to AiiM portfolio companies, with a particular focus on leadership and teams, organizational design and behaviors, and marketing. She has more than 25 years of experience in technology startup companies in online marketplaces, media, and community-building, including at eBay, where she joined the founders as employee #3.

Advisors

Contact Us

Entrepreneurs, investors and general inquiries, please use this form to get in touch.

Alpha Impact Investment Management, Palo Alto, CA

Palo Alto, CA

info@aiimpartners.com

.jpg?width=5572&height=3715&name=bluenalufacility-43%20(1).jpg)